Odoo Supports Various Methods Of Recording Transitions Where Cash Basis &

Accrual Accounting Are The Main Accounting Methods

As a business management software, Odoo is built to combine numerous business

applications into a unified platform. It is designed to support various accounting

methods, where cash basis and accrual basis are the primary methods. An

accounting method underlines the rules and processes to record revenues and

expenses of a company.

Financial management is one of the significant aspects of any business, be it for a construction industry, where opting for the right accounting method becomes important. Odoo accounting ensures you have a lot on your plate to select from, particularly between two primary methods: accrual and cash basis accounting. One can opt for the right method only when he knows it in detail.

The blogpost will explore and discover each of the methods i.e. accrual and cash

basis accounting, and guide you through the right choice.

What is Cash Basis Accounting?

Cash basis accounting is done when payments are made before confirming an

invoice. Thus, it refers to a system recording transactions when cash is received or

paid. It is considered a simpler form of accounting that involves actual cash

transfers.

It is often used by small businesses and individuals mainly due to its simpler

process. Cash accounting is not taken into consideration when accounts are

receivable or payable. Talking about the construction industry, some may prefer

cash-based accounting as they have to work on long project cycles that get delayed

payments

Tutorial- Cash Basis Accounting in Odoo

First, let’s begin by switching to cash basis accounting in Odoo:

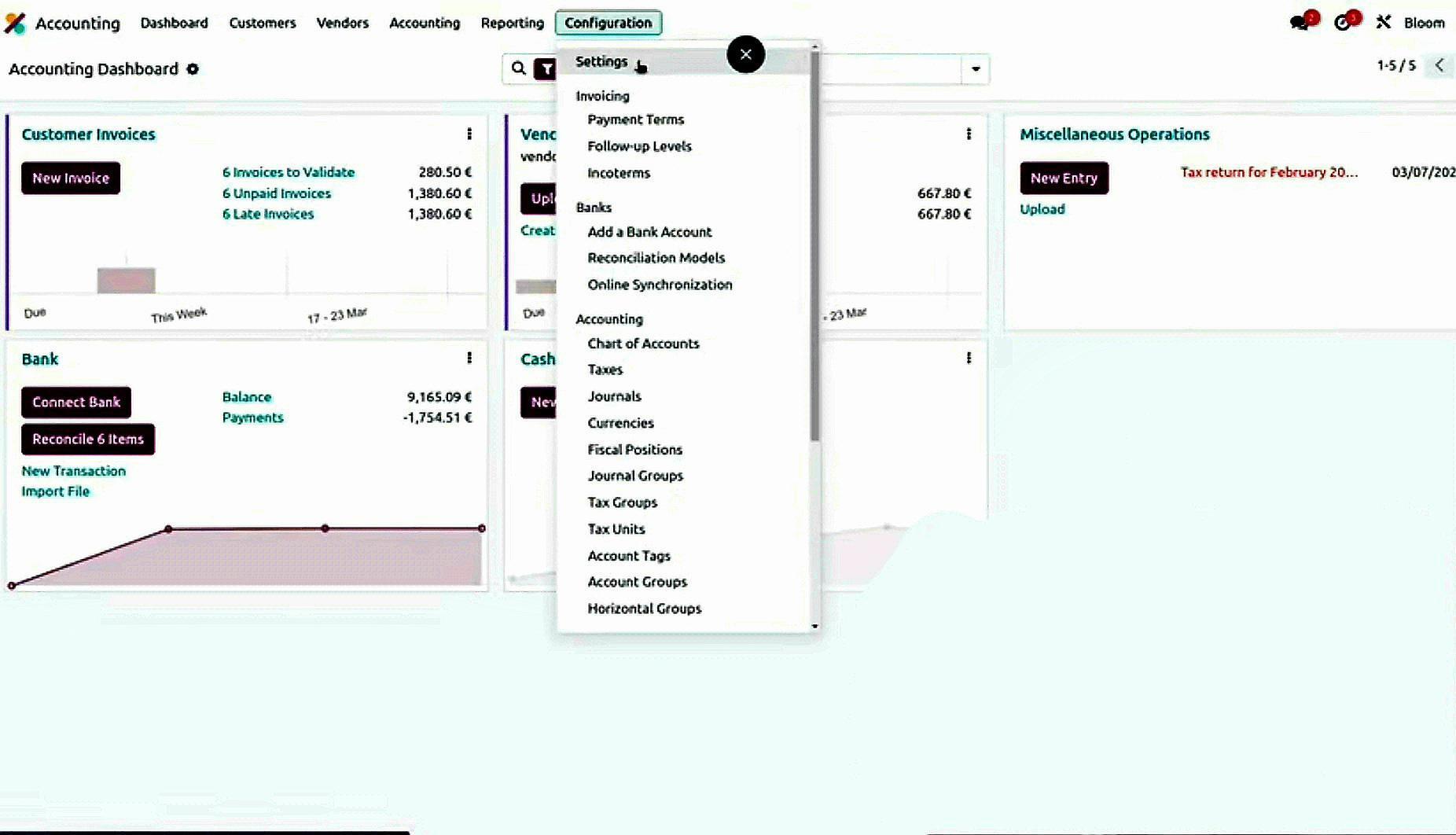

Go to the accounting settings-> Odoo dashboard-> Accounting->

Configuration->Settings.

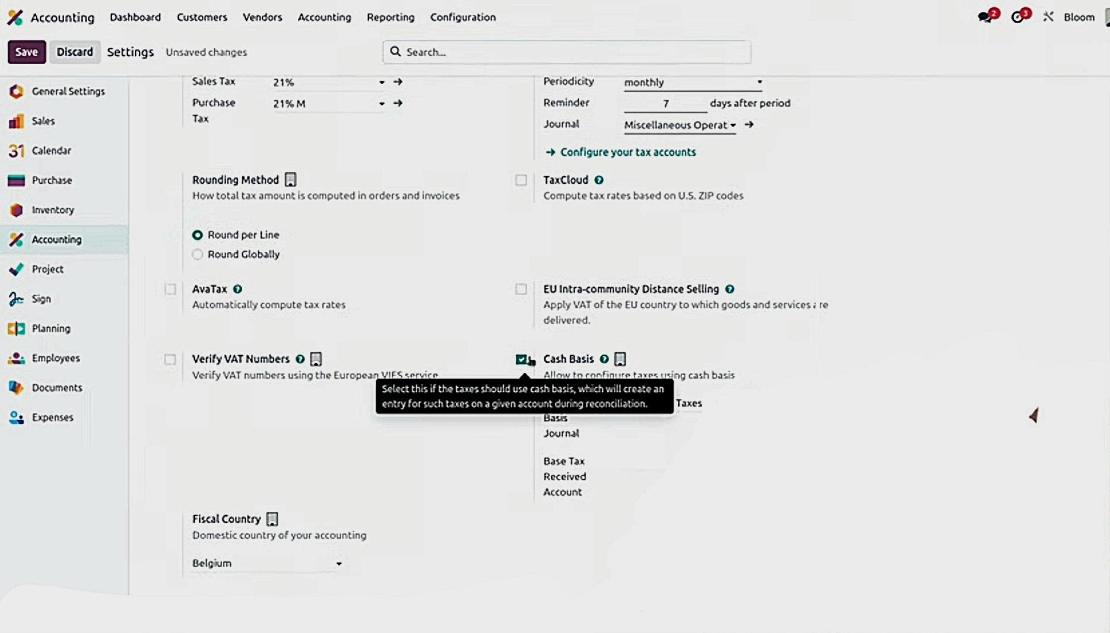

● Then, enable the cash basis method in the settings by clicking on the box next to it, and save your changes

Now, we can also create an expense record, here maintenance expense refers to the amount paid by the company.

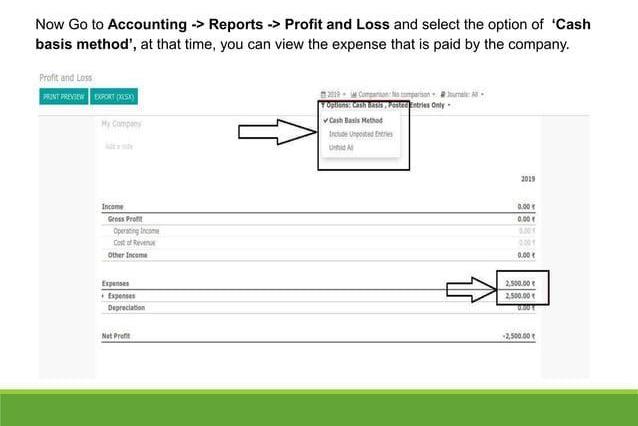

● Go to Accounting-> Reports -> Profit and Loss and select the Cash Basis method.

● Then we can see the expense paid by the company

What is Accrual Accounting?

When the payment has not been received and the expenses are not paid by the

company, you can log the revenues and expenses that incur using accrual

accounting. Aligning with the matching principle, the revenue and expenses are

recorded in the same time frame. In this method, cash is either not fully paid or

received by the company.

Additionally, this method can be helpful in providing a detailed view of a

company’s financial performance over a period. Thus, it can help in creating

accurate financial statements and plan future budgets. It is suitable for larger

businesses, and publicly traded companies.

Accrual Accounting in Odoo

Accrual accounting is the standard method in Odoo. It automatically uses the accrual mode, unless you switch to a cash basis method. You can verify or switch back to accrual accounting from the cash basis method by simply following the steps as above.

Comparing the two- Accrual Accounting and Cash Basis Accounting

Transaction recordings can be pursued using various methods, where accrual

accounting and cash basis accounting can be considered as primary ones. While

there can be many differences between them, timing of recording a transaction

becomes a major one. Cash basis and accrual accounting differ in how transactions

are recorded: immediate money exchange in cash basis and billing in accrual.

Despite potential outcome similarities over time, timing of revenue and expense

recording varies.

The various point of differences are depicted in the table below:

Basis for Comparison | Cash Basis of Accounting | Accrual Basis of Ac |

Meaning | Records are updated for income and expenses only when payments are made or received i.e. actual cash flow | Income recorded when earned, and expenses when they incur. |

Recording of Transactions | Only cash transactions are recorded. | Both cash and credit transactions are recorded. |

Revenue | Cash is received | Revenue is earned |

Expense | Cash is paid | Expense is incurred |

Income Statement | Income statement shows lower income. | Income statement will show a comparatively higher income. |

Profit or Loss | Correct profit or loss is not ascertained because it records only cash transactions. | Correct profit or loss is ascertained due to the complete record of transactions. |

Simple Vs Technical | It is simple to adopt because no technical knowledge is required in recording cash transactions. | It is technical in nature. |

Get FREE Consultation With Odoo Accounting Experts!

Choosing the Right Option For Odoo Accounting

The right answer depends on the type and extent of your business. With respect to the construction accounting, it has a project-based work system and long-term production cycles, where the contractors prefer to segregate their revenues and profits for the ease of organizing each project. In terms of the cash basis method, advantages can include easy use, immediate access to cash balance, and a simplified approach. For accrual accounting, it can prove beneficial in providing detailed financial assessment.

Therefore, in case of short-term projects, a cash basis can be a better option as it

can be a straightforward approach. As for a large company, an accrual basis will

work for better taxiing procedures.

Conclusion

Your business type and goals are determinants of your choice. If your business

thrives on simplicity and a controlled cash flow, cash basis accounting can be a

good choice. For more detailed financial scope, accrual accounting can be ideal. As

per the needs of your business, you can choose either of the methods with the help

of Odoo accounting which supports both.

If you want to optimize Odoo accounting as per your business needs, you can reach out to Silent Infotech. With a team of experts, they can customize and streamline your accounting procedures, while also mastering Odoo accounting. You can further improve your accounting methods, and improve the overall efficiency.

ilesh M

Ilesh is a tech-savvy project manager at Silent Infotech, specializing in Odoo ERP and Salesforce. With a passion for innovation and a deep understanding of diverse technologies, he has successfully delivered cutting-edge solutions to numerous projects. Ilesh's expertise extends to blockchain technologies, IOT, AI, and Other trending technologies reflecting his commitment to staying ahead in the dynamic world of IT. As a dedicated professional with a love for problem-solving, he continues to make a significant impact in the field of ERP and other software solutions.

Schedule Consultation with ilesh Schedule Now